Set your child up for financial success

Trump Accounts help you create a retirement nest egg for your child from birth. Get simple guides and updates on the $1,000 contribution program.

Stay informed

Get updates on key dates and next steps as the program rolls out.

We respect your privacy. Unsubscribe at any time.

Do you qualify?

Do you have a child under age 18?

Financial basics

Simple answers to your big questions.

What is a Trump Account?

Think of it like a special retirement piggy bank for your child. It grows tax-free until they grow up!

Learn more →When does it start?

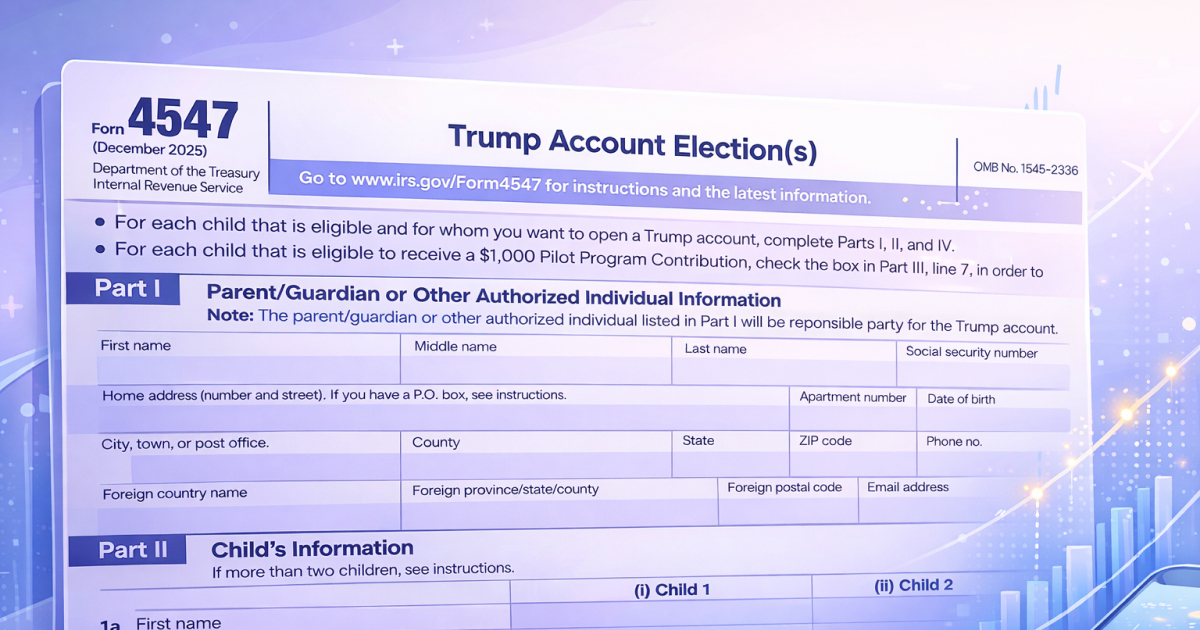

Sign-ups are open now — file IRS Form 4547 with your 2025 tax return or at TrumpAccounts.gov. Contributions begin July 4, 2026.

See timeline →What should I do now?

Relax! Just learn the basics and join our email list. We'll tell you exactly when it's time to take action.

Get updates →Timeline to watch

We're keeping track of the official dates so you don't have to.

Account claiming begins

File Form 4547 with your 2025 tax return or via TrumpAccounts.gov.

Online portal goes live

TrumpAccounts.gov now accepts Form 4547 electronically.

Activation steps

Treasury will send authentication information so families can complete account setup.

Contributions open

You can start adding money to the account (and potential government matches begin).

How it works

The 90-second version.

Open or claim

A parent completes the official election process.

Activate account

Follow the setup steps to get the account ready.

Contribute

Up to $5,000/yr in standard contributions permitted.

Watch it grow

Funds are invested in low-fee index funds until age 18.

What are Trump Accounts?

Trump Accounts are a new type of investment account designed to help children build long-term wealth. Key points:

- The federal government will deposit $1,000 into an account for each eligible child born 2025 to 2028, and families and their employers can add their own contributions over time.

- Contributions to the account will be invested in low-fee, broad-based index or mutual funds.

- Funds cannot be withdrawn before age 18.

- At age 18, the account becomes a traditional IRA account into which the child can continue to contribute toward their retirement.

Family Guide to

Education Savings

Trump Accounts are a great savings tool — but are they the best choice for education? This free guide compares Trump Accounts, 529 plans, and other options to help you build the right strategy for your family.

Scott Morrison

Editor · Saving For College

Don't miss the rollout

We'll send you plain-English alerts when it's time to act.

Common questions

No. TrumpAccounts.com is a helpful independent guide. We translate the complex rules into plain English for families. For official actions, you'll need to go to TrumpAccounts.gov.

For employers and organizations

Employer contributions

Employers may be able to contribute to eligible children's accounts under program rules. If you're exploring this as a benefit, we can send updates as guidance clarifies operational details.

Organization contributions

Certain organizations may be able to fund contributions for defined classes of beneficiaries under program rules. We'll share updates on processes, minimums, and timing as they're released.